SECURITIES

AND EXCHANGE COMMISSION

|

|

x

|

QUARTERLY REPORT PURSUANT TO

SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

|

For

the Quarterly Period Ended: September 30, 2009

OR

|

|

¨

|

TRANSITION REPORT PURSUANT TO

SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

|

For

the Transition Period from _________ to ___________

Commission

File Number 001-34506

TWO

HARBORS INVESTMENT CORP.

(Exact

Name of Registrant as Specified in Its Charter)

| |

Maryland

|

|

27-0312904

|

| |

(State

or Other Jurisdiction of

|

|

(I.R.S.

Employer

|

| |

Incorporation

or Organization)

|

|

Identification

No.)

|

| |

601 Carlson Parkway, Suite 330

|

|

|

| |

Minnetonka,

Minnesota

|

|

55305

|

| |

(Address

of Principal Executive Offices)

|

|

(Zip

Code)

|

(612)

238-3300

(Registrant’s

Telephone Number, Including Area Code)

not

applicable

(Former

Name, Former Address and Former Fiscal Year, if Changed Since Last

Report)

Indicate

by check mark whether the registrant (1) has filed all reports required to be

filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

preceding 12 months (or for such shorter period that the registrant was required

to file such reports), and (2) has been subject to such filing requirements for

the past 90 days. Yes ¨ No x

Indicate

by check mark whether the registrant has submitted electronically and posted on

its corporate Web site, if any, every Interactive Data File required to be

submitted and posted pursuant to Rule 405 of Regulation S T (§232.405 of this

chapter) during the preceding 12 months (or for such shorter period that the

registrant was required to submit and post such

files). Yes ¨ No ¨

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non accelerated filer or smaller reporting company. See

definition of “large accelerated filer,” “accelerated filer,” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large

accelerated filer ¨ Accelerated

filer ¨ Non-accelerated

filer x Smaller

reporting company ¨

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Exchange Act). Yes ¨ No x

Indicate

the number of shares outstanding of each of the issuer’s classes of common

stock, as of the latest practicable date.

As of

December 11, 2009 there were 13,379,209 shares of registered common stock, par

value $.0001 per share, issued and outstanding.

TWO

HARBORS INVESTMENT CORP.

(a

development stage company)

2009

FORM 10-Q REPORT

TABLE

OF CONTENTS

|

PART

I – FINANCIAL INFORMATION

|

|

|

|

|

|

Item

1. Financial

Statements

|

|

|

3 |

|

|

Item

2. Management’s

Discussion and Analysis of Financial Condition and Results of

Operations

|

|

|

15 |

|

|

Item

3. Quantitative and

Qualitative Disclosures about Market Risk

|

|

|

25 |

|

|

Item

4. Controls and

Procedures

|

|

|

27 |

|

|

|

|

|

|

|

|

PART

II – OTHER INFORMATION

|

|

|

|

|

|

Item

1. Legal

Proceedings

|

|

|

28 |

|

|

Item

1A. Risk

Factors

|

|

|

28 |

|

|

Item

2. Unregistered Sales of

Equity Securities and Use of Proceeds

|

|

|

54 |

|

|

Item

3. Defaults Upon Senior

Securities

|

|

|

55 |

|

|

Item

4. Submission of Matters

to a Vote of Security Holders

|

|

|

55 |

|

|

Item

5. Other

Information

|

|

|

55 |

|

|

Item

6.

Exhibits

|

|

|

55 |

|

PART

I – FINANCIAL INFORMATION

Item

1. Financial

Statements

TWO

HARBORS INVESTMENT CORP.

(a

development stage company)

CONDENSED

CONSOLIDATED BALANCE SHEETS

|

|

|

September

30,

|

|

|

December

31,

|

|

|

|

|

2009

|

|

|

2008

|

|

|

|

|

(Unaudited)

|

|

|

|

|

|

ASSETS

|

|

|

|

|

|

|

|

Current

assets

|

|

|

|

|

|

|

|

Cash

|

|

$ |

1,253,979

|

|

|

$ |

2,778,143 |

|

|

Cash

held in Trust Account, interest and dividend income available for

taxes

|

|

|

21,755 |

|

|

|

134,385

|

|

|

Other

current assets

|

|

|

34,877

|

|

|

|

50,290

|

|

|

Total

current assets

|

|

|

1,310,611 |

|

|

|

2,962,818 |

|

|

Cash

held in Trust Account, restricted

|

|

|

259,027,351

|

|

|

|

259,084,043

|

|

|

Prepaid

income taxes

|

|

|

414,537 |

|

|

|

48,269 |

|

|

Total

Assets

|

|

$ |

260,752,499

|

|

|

$ |

262,095,130 |

|

|

LIABILITIES

AND STOCKHOLDERS’ EQUITY

|

|

|

|

|

|

|

|

|

|

Liabilities

|

|

|

|

|

|

|

|

|

|

Current

liabilities

|

|

|

|

|

|

|

|

|

|

Accounts

payable and accrued expenses

|

|

$ |

1,173,743 |

|

|

$ |

193,555 |

|

|

Total

current liabilities

|

|

|

1,173,743 |

|

|

|

193,555 |

|

|

Common

stock, subject to possible conversion, 7,874,699 shares at conversion

value

|

|

|

77,832,556

|

|

|

|

77,739,684 |

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders’

Equity

|

|

|

|

|

|

|

|

|

|

Registered

Preferred Stock of Capitol Acquisition Corp., par value $0.0001 per share,

1,000,000 authorized; none issued and oustanding

|

|

|

- |

|

|

|

- |

|

|

Registered

Common Stock of Capitol Acquisition Corp., par value $0.0001 per share,

75,000,000 shares authorized; 32,811,257 issued and oustanding (less

7,874,699 subject to possible conversion)

|

|

|

2,494

|

|

|

|

2,494 |

|

|

Privately

issued common stock, $0.01 par, 1,000 shares authorized, issued, and

outstanding to Pine River Capital Management

|

|

|

10 |

|

|

|

- |

|

|

Additional

paid-in capital

|

|

|

181,058,409

|

|

|

|

181,150,291 |

|

|

Cumulative

earnings

|

|

|

685,287 |

|

|

|

3,009,106 |

|

|

Total

stockholders’ equity

|

|

|

181,746,200

|

|

|

|

184,161,891 |

|

|

Total

Liabilities and Stockholders’ Equity

|

|

$ |

260,752,499 |

|

|

$ |

262,095,130 |

|

The

accompanying notes are an integral part of these consolidated financial

statements.

TWO

HARBORS INVESTMENT CORP.

(a

development stage company)

CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS

(UNAUDITED)

|

|

|

Three

Months Ended

|

|

|

Nine

Months Ended

|

|

|

|

|

|

|

|

September

30,

|

|

|

September

30,

|

|

|

|

|

|

|

|

2009

|

|

|

2008

|

|

|

2009

|

|

|

2008

|

|

|

September 30,

2009

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

|

General

and administrative expenses

|

|

|

1,040,300

|

|

|

|

225,564

|

|

|

|

2,746,409

|

|

|

|

776,333

|

|

|

|

3,947,014 |

|

|

Loss

from operations

|

|

|

(1,040,300 |

)

|

|

|

(225,564 |

)

|

|

|

(2,746,409 |

)

|

|

|

(776,333 |

)

|

|

|

(3,947,014 |

)

|

|

Interest

and dividend income

|

|

|

890 |

|

|

|

956,751 |

|

|

|

56,322 |

|

|

|

4,060,613 |

|

|

|

5,972,764 |

|

|

(Loss)

income before benefit from (provision for) income taxes

|

|

|

(1,039,410 |

)

|

|

|

731,187

|

|

|

|

(2,690,087 |

)

|

|

|

3,284,280

|

|

|

|

2,025,750 |

|

|

Benefit

from (provision for) income taxes

|

|

|

119,483 |

|

|

|

(182,556 |

) |

|

|

366,268 |

|

|

|

(1,052,854 |

) |

|

|

(1,340,463 |

) |

|

Net

(loss) income

|

|

|

(919,927 |

)

|

|

|

548,631

|

|

|

|

(2,323,819 |

)

|

|

|

2,231,426

|

|

|

|

685,287 |

|

|

Accretion

of Trust Account income relating to common stock subject to possible

conversion

|

|

|

(24,723 |

)

|

|

|

(143,217 |

)

|

|

|

(92,872 |

)

|

|

|

(143,217 |

)

|

|

|

(328,578 |

)

|

|

Net

(loss) income attributable to other common shareholders

|

|

$ |

(944,650 |

)

|

|

$ |

405,414 |

|

|

$ |

(2,416,691 |

)

|

|

$ |

2,088,209 |

|

|

$ |

356,709 |

|

|

Weighted

average number of registered common shares outstanding, excluding shares

subject to possible conversion and privately issued shares - basic and

diluted

|

|

|

24,936,558 |

|

|

|

24,936,558 |

|

|

|

24,936,558 |

|

|

|

24,936,558 |

|

|

|

24,936,558 |

|

|

Basic

and diluted net (loss) earnings per share attributable to registered

common stockholders:

|

|

$ |

(0.04 |

)

|

|

$ |

0.02 |

|

|

$ |

(0.10 |

)

|

|

$ |

0.08 |

|

|

$ |

0.01 |

|

* Inception

date of Capitol Acquisition Corp. as a development stage company

The

accompanying notes are an integral part of these consolidated financial

statements.

TWO

HARBORS INVESTMENT CORP.

(a

development stage company)

CONDENSED

CONSOLIDATED STATEMENT OF CHANGES IN STOCKHOLDER'S EQUITY

FOR

THE PERIOD FROM JUNE 26, 2007 (INCEPTION) THROUGH SEPTEMBER 30,

2009

(UNAUDITED)

|

|

|

Registered Common Stock of Capitol Acquisition

Corp.

|

|

|

Private Common Stock of Two Harbors Investment

Corp.

|

|

|

Additional

|

|

|

Cumulative

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Paid-in

|

|

|

(Losses)

|

|

|

|

|

|

|

|

Shares

|

|

|

Amount

|

|

|

Shares

|

|

|

Amount

|

|

|

Capital

|

|

|

Earnings

|

|

|

Total

|

|

|

Balance

at June 2007 (inception of Capitol Acquisition Corp.)

|

|

|

-

|

|

|

$ |

- |

|

|

|

- |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

|

Common

shares issued at inception at $0.003 per share

|

|

|

7,187,500 |

|

|

|

719 |

|

|

|

- |

|

|

|

- |

|

|

|

24,281 |

|

|

|

- |

|

|

|

25,000 |

|

|

Sale

of 25,000,000 units, net of Underwriters' discount and offering expenses

(includes 7,499,999 shares subject to possible conversion)

|

|

|

25,000,000

|

|

|

|

2,500

|

|

|

|

- |

|

|

|

-

|

|

|

|

239,843,344

|

|

|

|

-

|

|

|

|

239,845,844 |

|

|

Exercise

of Underwriters' over-allotment, net of Underwriters' discount and

offering expenses (includes 374,700 shares subject to possible

conversion)

|

|

|

1,249,000 |

|

|

|

125 |

|

|

|

- |

|

|

|

- |

|

|

|

12,021,500 |

|

|

|

- |

|

|

|

12,021,625 |

|

|

Forfeiture

of initial stockholders' shares pursuant to partial exercise of

underwriters' over-allotment

|

|

|

(625,243 |

)

|

|

|

(62 |

)

|

|

|

- |

|

|

|

-

|

|

|

|

62

|

|

|

|

-

|

|

|

|

- |

|

|

Proceeds

subject to possible conversion of 7,874,699 shares

|

|

|

- |

|

|

|

(788 |

)

|

|

|

- |

|

|

|

-

|

|

|

|

(77,503,190 |

)

|

|

|

-

|

|

|

|

(77,503,978 |

)

|

|

Proceeds

from issuance of sponsors' warrants, at $1 per warrant

|

|

|

- |

|

|

|

-

|

|

|

|

- |

|

|

|

-

|

|

|

|

7,000,000

|

|

|

|

-

|

|

|

|

7,000,000 |

|

|

Net

income for the period from June 26, 2007 (inception) through December 31,

2007

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

714,573 |

|

|

|

714,573 |

|

|

Balance,

December 31, 2007

|

|

|

32,811,257

|

|

|

|

2,494

|

|

|

|

- |

|

|

|

-

|

|

|

|

181,385,997

|

|

|

|

714,573

|

|

|

|

182,103,064 |

|

|

Accretion

of Trust Account income relating to common stock subject to possible

conversion

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(143,217 |

) |

|

|

- |

|

|

|

(143,217 |

) |

|

Net

income for the nine months ended September 30, 2008

|

|

|

- |

|

|

|

-

|

|

|

|

- |

|

|

|

-

|

|

|

|

-

|

|

|

|

2,231,426

|

|

|

|

2,231,426 |

|

|

Balance,

September 30, 2008

|

|

|

32,811,257 |

|

|

|

2,494 |

|

|

|

- |

|

|

|

- |

|

|

|

181,242,780 |

|

|

|

2,945,999 |

|

|

|

184,191,273 |

|

|

Accretion

of Trust Account income relating to common stock subject to possible

conversion

|

|

|

- |

|

|

|

-

|

|

|

|

- |

|

|

|

-

|

|

|

|

(92,489 |

)

|

|

|

-

|

|

|

|

(92,489 |

)

|

|

Net

income for the three months ended December 31, 2008

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

63,107 |

|

|

|

63,107 |

|

|

Balance,

December 31, 2008

|

|

|

32,811,257

|

|

|

|

2,494

|

|

|

|

- |

|

|

|

-

|

|

|

|

181,150,291

|

|

|

|

3,009,106

|

|

|

|

184,161,891 |

|

|

Initial

capital issuance and contribution from formation of Two Harbors Investment

Corp.

|

|

|

- |

|

|

|

- |

|

|

|

1,000 |

|

|

|

10 |

|

|

|

990 |

|

|

|

- |

|

|

|

1,000 |

|

|

Accretion

of Trust Account income relating to common stock subject to possible

conversion

|

|

|

- |

|

|

|

-

|

|

|

|

- |

|

|

|

-

|

|

|

|

(92,872 |

)

|

|

|

-

|

|

|

|

(92,872 |

)

|

|

Net

loss for the nine months ended September 30, 2009

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(2,323,819 |

)

|

|

|

(2,323,819 |

)

|

|

Balance,

September 30, 2009

|

|

|

32,811,257

|

|

|

$ |

2,494 |

|

|

|

1,000 |

|

|

$ |

10 |

|

|

$ |

181,058,409 |

|

|

$ |

685,287 |

|

|

$ |

181,746,200 |

|

The

accompanying notes are an integral part of these consolidated financial

statements.

TWO

HARBORS INVESTMENT CORP.

(a

development stage company)

CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

| |

|

|

|

|

|

|

|

For

the period from June 26,

|

|

|

|

|

Nine Months

Ended |

|

|

Nine

Months Ended

|

|

|

2007*

through September

|

|

|

|

|

September

30, 2009

|

|

|

September

30, 2008

|

|

|

30,

2009

|

|

|

Cash

Flows From Operating Activities:

|

|

|

|

|

|

|

|

|

|

|

Net

(loss) income

|

|

$ |

(2,323,819 |

) |

|

$ |

2,231,426 |

|

|

$ |

685,287 |

|

|

Adjustments

to reconcile net (loss) income to net cash (used in) provided by operating

activities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net

change in operating assets and liabilities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Decrease

(Increase) in other current assets

|

|

|

15,413

|

|

|

|

(45,031 |

)

|

|

|

(34,877 |

)

|

|

Increase

in prepaid corporate taxes

|

|

|

(366,268 |

) |

|

|

- |

|

|

|

(414,537 |

) |

|

(Decrease)

in corporate taxes payable

|

|

|

- |

|

|

|

(552,146 |

)

|

|

|

- |

|

|

Increase

in accounts payable and accrued expenses

|

|

|

980,188

|

|

|

|

71,763

|

|

|

|

1,173,743 |

|

|

Net

cash (used in) provided by operating activities

|

|

|

(1,694,486 |

)

|

|

|

1,706,012

|

|

|

|

1,409,616 |

|

|

Cash

Flows From Investing Activities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Trust

Account, restricted

|

|

|

56,692

|

|

|

|

(477,391 |

)

|

|

|

(259,027,351 |

)

|

|

Cash

held in Trust Account, interest and dividend income available for working

capital and taxes

|

|

|

112,630 |

|

|

|

594,724 |

|

|

|

(21,755 |

) |

|

Net

cash (used in) provided by investing activities

|

|

|

169,322

|

|

|

|

117,333

|

|

|

|

(259,049,106 |

)

|

|

Cash

Flows From Financing Activities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross

proceeds from initial public offering

|

|

|

- |

|

|

|

-

|

|

|

|

250,000,000 |

|

|

Gross

proceeds from exercise of underwriters' over-allotment

|

|

|

- |

|

|

|

- |

|

|

|

12,490,000 |

|

|

Proceeds

from notes payable, stockholders

|

|

|

- |

|

|

|

-

|

|

|

|

95,000 |

|

|

Re-payment

of notes payable, stockholders

|

|

|

- |

|

|

|

- |

|

|

|

(95,000 |

) |

|

Proceeds

from issuance of stock to initial shareholders

|

|

|

- |

|

|

|

-

|

|

|

|

25,000 |

|

|

Proceeds

from issuance of private stock for the formation of Two Harbors Investment

Corp.

|

|

|

1,000 |

|

|

|

- |

|

|

|

1,000 |

|

|

Proceeds

from issuance of sponsors' warrants

|

|

|

-

|

|

|

|

-

|

|

|

|

7,000,000 |

|

|

Payment

of underwriting discount and offering expenses

|

|

|

- |

|

|

|

- |

|

|

|

(10,622,531 |

) |

|

Net

cash provided by financing activities

|

|

|

1,000

|

|

|

|

-

|

|

|

|

258,893,469 |

|

|

Net

(decrease) increase in cash and cash equivalents

|

|

|

(1,524,164 |

) |

|

|

1,823,345 |

|

|

|

1,253,979 |

|

|

Cash

and cash equivalents at beginning of period

|

|

|

2,778,143

|

|

|

|

461,475

|

|

|

|

- |

|

|

Cash

and cash equivalents at end of period

|

|

$ |

1,253,979 |

|

|

$ |

2,284,820 |

|

|

$ |

1,253,979 |

|

|

Supplemental

Disclosure of Cash Flow Information:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash

(received) paid for taxes

|

|

$ |

- |

|

|

$ |

1,605,000 |

|

|

$ |

1,755,000 |

|

|

Non-Cash

Financing Activity:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accrual

for offering costs charged to additional paid in capital

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

511 |

|

|

Accretion

of trust account income relating to common stock subject to possible

conversion

|

|

$ |

92,872 |

|

|

$ |

143,217 |

|

|

$ |

328,578 |

|

* Inception

date of Capitol Acquisition Corp. as a development stage company

The

accompanying notes are an integral part of these consolidated financial

statements.

TWO

HARBORS INVESTMENT CORP.

(a

development stage company)

NOTES TO

UNAUDITED FINANCIAL STATEMENTS

Note

1. Organization and Operations

Two

Harbors Investment Corp. (“the Company”) is a Maryland corporation formed to

invest primarily in residential mortgage-backed securities. The Company is

externally managed and advised by PRCM Advisers LLC, a subsidiary of Pine River

Capital Management L.P. (“Pine River”), a global multi-strategy asset management

firm. The Company’s common stock and warrants are listed on the NYSE

Amex under the symbols “TWO” and “TWO.WS,” respectively.

The

Company intends to elect and qualify to be taxed as a real estate investment

trust (“REIT”) for U.S. federal income tax purposes commencing with its initial

taxable period ending December 31, 2009. As long as the Company

qualifies as a REIT, the Company generally will not be subject to U.S. federal

income tax to the extent that the Company distributes its taxable income to its

stockholders on an annual basis.

On

June 11, 2009, the Company, Two Harbors Merger Corp. (a wholly-owned subsidiary

of the Company), Pine River and Capitol Acquisition Corp. (“Capitol”) entered

into a merger agreement, which, among other things, provided for the merger of

Capitol into Two Harbors Merger Corp., with Capitol being the surviving entity

and becoming an indirect wholly-owned subsidiary of the Company.

Capitol,

a development stage company, was formed on June 26, 2007 as a publicly

registered vehicle to effect a merger, capital stock exchange, asset acquisition

or other similar business combination with an operating business. On

November 14, 2007, Capitol consummated its initial public offering (the “IPO”)

and deposited $258,346,625 of net proceeds into the Trust Account, with such

funds to be held in trust until the earlier of the completion of Capitol’s

initial business combination or November 8, 2009.

The

Company was formed solely to complete the merger transaction with Capitol and,

prior to such time, had no material assets or liabilities. On October

26, 2009, a majority of Capitol’s stockholders approved the proposed merger

transaction with the Company, and the transaction closed on October 28,

2009. As part of the merger transaction, certain of Capitol’s

officers, directors and special advisors (the “Initial Stockholders”)

surrendered their common stock to the Company for no consideration, and their

shares were cancelled. At the closing of the merger transaction,

certain holders of common stock that was sold as part of the IPO elected to

convert their shares to cash, or sold their shares to the Company, in each case

for a price equal to the per share value of cash held in trust, or $9.87 per

share. At the closing, after deducting transaction costs and

expenses, and after purchasing or converting to cash the shares of common stock

of Capitol stockholders who did not to participate in the merger, the Company

had approximately $124 million in cash available to fund investments and

operations, and a book value of approximately $9.30 per share. The

remaining Capitol stockholders, and all Capitol warrant holders, exchanged their

Capitol shares and warrants for Company shares and warrants on a one-for-one

basis. The new shares and warrants became available to be traded on

the NYSE Amex as of October 29, 2009. The Capitol shares and warrants

were retired and delisted upon completion of the

merger. Capitol ceased being a development stage company at the

completion of the merger.

Upon

completion of the merger, Capitol was considered the accounting acquirer,

similar to a reverse merger. As the surviving entity, Capitol’s financial

information is presented in this Form 10-Q on a historical carryover basis and

the Company has assumed Capitol’s reporting obligations for the period ended

September 30, 2009. As a result, these financial statements are not

indicative of the consolidated financial statements of the Company subsequent to

October 28, 2009. See Note 7 – Subsequent Events of the

Notes to Financial Statements for expanded discussion of the completed

merger.

TWO

HARBORS INVESTMENT CORP.

(a

development stage company)

NOTES TO

UNAUDITED FINANCIAL STATEMENTS

Note

2. Basis of Presentation and Significant Accounting

Policies

Consolidation

and Basis of Presentation

These

unaudited, condensed, consolidated interim financial statements of the Company,

as of September 30, 2009, and for the three and nine months ended September 30,

2009 and 2008, and for the period from June 26, 2007 (inception date of

Capitol, a development stage company) through September 30, 2009, have been

prepared in accordance with accounting principles generally accepted in the

United States of America, for interim financial information and with the

instructions to Form 10-Q. Accordingly, they do not include all of

the information and footnotes required by accounting principles generally

accepted in the United States of America for complete financial

statements. In the opinion of management, all adjustments (consisting

of normal recurring accruals) considered necessary for a fair presentation have

been included. Operating results for the interim periods presented

are not necessarily indicative of the results to be expected for any other

interim period or for the full year.

These

unaudited condensed, consolidated interim financial statements should be read in

conjunction with the audited financial statements of Capitol and notes thereto

as of December 31, 2008, and for the period ended December 31, 2008

included in Capitol’s Form 10-K filed on March 16, 2009. The

accounting policies used in preparing these unaudited condensed interim

financial statements are consistent with those described in the

December 31, 2008 financial statements.

Summary

of Significant Accounting Policies

Use

of Estimates

The

preparation of financial statements in conformity with accounting principles

generally accepted in the United States of America requires management to make

estimates and assumptions that affect the reported amounts of assets and

liabilities and disclosure of contingent assets and liabilities at the date of

the financial statements and the reported amounts of expenses during the

reporting period. Actual results could differ from those

estimates.

Reclassifications

Certain

amounts in the prior quarters’ condensed financial statements have been

reclassified to conform with the presentation in the current year condensed,

consolidated financial statements. These reclassifications have no

effect on previously reported income.

Cash

and Cash Equivalents

Cash and

cash equivalents include cash in bank and cash held in money market funds on an

overnight basis. The Company is required to disclose significant

concentrations of credit risk regardless of the degree of risk. At

September 30, 2009, financial instruments that potentially expose the

Company to credit risk consist of cash and cash equivalents held in the Trust

Account. The Company maintains its Trust Account cash balances in a

U.S. Treasury only money market fund at one financial institution and its

working capital cash balance at another financial institution. As of

September 30, 2009 the Federal Deposit Insurance Corporation insured

balances in bank accounts up to $250,000 and the Securities Investor Protection

Corporation insured balances up to $500,000 in brokerage accounts.

TWO

HARBORS INVESTMENT CORP.

(a

development stage company)

NOTES TO

UNAUDITED FINANCIAL STATEMENTS

Accretion

of Trust Account Relating to Common Stock Subject to Possible

Conversion

The

Company records accretion of the income earned in the Trust Account relating to

the common stock subject to possible conversion based on the excess of the

earnings for the period over the amount which is available to be used for

working capital and taxes. Since 30% (less one share) of the shares

issued in the IPO are subject to possible conversion, the portion of the excess

earnings related to those shares are reflected on the balance sheet as part of

“Common stock subject to possible conversion” and is deducted from “Additional

paid-in capital.” This portion of the excess earnings is also

presented as a deduction from net (loss) income on the Statements of Operations

to appropriately reflect the amount of net (loss) income which would remain

available to the common stockholders who did not elect to convert their shares

to cash.

Taxes

The

Company intends to elect to be taxed as a REIT under the Internal Revenue Code

(“Code”) and the corresponding provisions of state law. To qualify as

a REIT the Company must distribute at least 90% of its annual REIT taxable

income to shareholders (not including taxable income retained in its taxable

subsidiaries) within the time frame set forth in the tax code and the Company

must also meet certain other requirements. In addition, because

certain activities, if performed by the Company, may cause the Company to earn

income which is not qualifying for the REIT gross income tests, the Company has

formed taxable REIT subsidiaries, as defined in the Code, to engage in such

activities.

The

Company assesses its tax positions for all open tax years and determines whether

the Company has any material unrecognized liabilities in accordance with overall

(“ASC 740-10”) codified guidance. The Company records these

liabilities to the extent the Company deems them incurred. The

Company classifies interest and penalties on material uncertain tax positions as

interest expense and operating expense, respectively, in its consolidated

statements of (loss) income.

As of

September 30, 2009 and the periods prior to that date, Capitol’s operations are

taxable as a domestic C corporation and subject to federal, state, and local

income taxes based upon its taxable income (loss).

(Loss)

Earning Per Share

Basic

(loss) earnings per share are computed by dividing net (loss) income by the

weighted average number of common shares outstanding during the

period. Diluted (loss) earnings per share are computed by dividing

net (loss) income by the weighted average number of common shares and potential

common shares outstanding during the period. Potential common shares

outstanding are calculated using the treasury stock method, which assumes that

all dilutive common stock equivalents are exercised and the funds generated by

the exercises are used to buy back outstanding common stock at the average

market price of the common stock during the reporting period. In accordance with

Earnings Per Share (“ASC 260”) codified guidance, if there is a loss from

continuing operations, the common stock equivalents are deemed anti dilutive and

diluted (loss) earnings per share is calculated in the same manner as basic

(loss) earnings per share.

As of

September 30, 2009, 7,874,699 shares of common stock that were subject to

possible conversion have been excluded from the calculation of basic and diluted

earnings per share because such shares, if converted, only participate in their

pro rata share of the trust earnings.

Earnings

(loss) per common share amounts, assuming dilution (“Diluted EPS”), gives effect

to dilutive options, warrants, and other potential common stock outstanding

during the period. ASC 260 requires the presentation of both Basic

EPS and Diluted EPS on the face of the statements of operations. In accordance

with ASC 260, the Company has not considered the effect of its outstanding

warrants in the calculation of diluted earnings per share because the exercise

of the warrants is contingent upon the occurrence of future

events.

TWO

HARBORS INVESTMENT CORP.

(a

development stage company)

NOTES TO

UNAUDITED FINANCIAL STATEMENTS

Recently

Issued Accounting Standards

General

Principles

Generally Accepted Accounting

Principles (ASC 105). In June 2009, the FASB issued The

Accounting Standards Codification and the Hierarchy of Generally Accepted

Accounting Principles (Codification) (the “Codification”) which revises the

framework for selecting the accounting principles to be used in the preparation

of financial statements that are presented in conformity with

GAAP. The objective of the Codification is to establish the FASB

Accounting Standards Codification (“ASC”) as the source of authoritative

accounting principles recognized by the FASB. In adopting the

Codification, all non-grandfathered, non-SEC accounting literature not included

in the Codification is superseded and deemed non-authoritative. The

Codification will require any references within the Company’s consolidated

financial statements to be modified from FASB issues to ASC. However,

in accordance with the FASB Accounting Standards Codification Notice to

Constituents (v 2.0), the Company will not reference specific sections of the

ASC but will use broad topic references. The Company’s recent

accounting pronouncements section has been reformatted to reflect the same

organizational structure as the ASC. Broad topic references will be

updated with pending content as they are released.

Assets

Investments in Debt and Equity

Securities (ASC 320). New guidance was provided to make

impairment guidance more operational and to improve the presentation and

disclosure of other-than-temporary impairments (“OTTI”) on debt and equity

securities in financial statements. The guidance revises the OTTI

evaluation methodology. Previously the analytical focus was on

whether a company had the “intent and ability to retain its investment in the

security for a period of time sufficient to allow for any anticipated recovery

in fair value.” Now the focus is on whether a company (1) has the

intent to sell the investment securities, (2) is more likely than not to be

required to sell the investment securities before recovery, or (3) does not

expect to recover the entire amortized cost basis of the investment securities.

Further, the security is analyzed for credit loss, (the difference between the

present value of cash flows expected to be collected and the amortized cost

basis). The credit loss, if any, will then be recognized in the

statement of operations, while the balance of impairment related to other

factors will be recognized in other comprehensive income. The

adoption of this ASC did not have a material impact on the Company’s

consolidated financial condition or results of operations for the period ending

September 30, 2009.

Broad

Transactions

Derivatives and Hedging (ASC 815).

Effective January 1, 2009, the FASB issued additional guidance attempting

to improve the transparency of financial reporting by mandating the provision of

additional information about how derivative and hedging activities affect an

entity’s financial position, financial performance and cash

flows. This guidance changed the disclosure requirements for

derivative instruments and hedging activities by requiring enhanced disclosure

about (1) how and why an entity uses derivative instruments, (2) how derivative

instruments and related hedged items are accounted for, and (3) how derivative

instruments and related hedged items affect an entity’s financial position,

financial performance, and cash flows. To adhere to this guidance,

qualitative disclosures about objectives and strategies for using derivatives,

quantitative disclosures about fair value amounts, gains and losses on

derivative instruments, and disclosures about credit risk-related contingent

features in derivative agreements must be made. This disclosure

framework is intended to better convey the purpose of derivative use in terms of

the risks that an entity is intending to manage. Because this ASC

impacts the disclosure and not the accounting treatment for derivative

instruments and related hedge items, the adoption of this ASC did not have an

impact on the Company’s consolidated financial condition or results of

operations.

TWO

HARBORS INVESTMENT CORP.

(a

development stage company)

NOTES TO

UNAUDITED FINANCIAL STATEMENTS

Fair Value Measurements and

Disclosures (ASC 820). In response to the deterioration of the

credit markets, the FASB issued guidance clarifying how fair value measurements

should be applied when valuing securities in markets that are not

active. It further clarifies how observable market information and

market quotes should be considered when measuring fair value in an inactive

market. It reaffirms the notion of fair value as an exit price as of

the measurement date and that fair value analysis is a transactional process and

should not be broadly applied to a group of assets. The guidance was

effective upon issuance including with respect to prior periods for which

financial statements had not been issued. The FASB also issued

additional guidance for determining fair value when the volume and level of

activity for an asset or liability have significantly decreased when compared

with normal market activity for the asset or liability (or similar assets or

liabilities). The guidance gives specific factors to evaluate if

there has been a decrease in normal market activity and if so, provides a

methodology to analyze transactions or quoted prices and make necessary

adjustments to fair value. The objective is to determine the point

within a range of fair value estimates that is most representative of fair value

under current market conditions. The Company does not foresee this

guidance having a material impact on the manner in which the Company expects to

estimate fair value. In August 2009, the FASB provided further

guidance regarding the fair value measurement of liabilities. The

guidance states that a quoted price for the identical liability when traded as

an asset in an active market is a Level 1 fair value measurement. If

the value must be adjusted for factors specific to the liability, then the

adjustment to the quoted price of the asset shall render the fair value

measurement of the liability a lower level measurement. The adoption

of this ASC did not have a material impact on the Company’s consolidated

financial condition or results of operations for the period ending September 30,

2009.

Financial Instruments (ASC

820-10-50). On April 9, 2009, the FASB issued guidance which requires

disclosures about fair value of financial instruments for interim reporting

periods as well as in annual financial statements. The effective date

of this guidance is for interim reporting periods ending after June 15, 2009

with early adoption permitted for periods ending after March 15,

2009. Because this ASC impacts the disclosure and not the accounting

treatment for financial instruments, the adoption of this ASC did not have an

impact on the Company’s consolidated financial condition or results of

operations.

Subsequent Events (ASC

855). ASC 855 provides general standards governing accounting

for and disclosure of events that occur after the balance sheet date but before

the financial statements are issued or are available to be

issued. ASC 855 also provides guidance on the period after the

balance sheet date during which management of a reporting entity should evaluate

events or transactions that may occur for potential recognition or disclosure in

the financial statements, the circumstances under which an entity should

recognize events or transactions occurring after the balance sheet date in its

financial statements and the disclosures that an entity should make about events

or transactions occurring after the balance sheet date. Because this

ASC impacts the disclosure and not the accounting treatment for subsequent

events, the adoption of this ASC did not have an impact on the Company’s

consolidated financial condition or results of operations.

Transfers and Servicing (ASC

860-10-50). In February 2008, the FASB issued guidance

addressing whether transactions where assets purchased from a particular

counterparty and financed through a repurchase agreement with the same

counterparty can be considered and accounted for as separate transactions, or

are required to be considered “linked” transactions and may be considered

derivatives. This guidance requires purchases and subsequent

financing through repurchase agreements to be considered linked transactions

unless all of the following conditions apply: (1) the initial purchase and the

use of repurchase agreements to finance the purchase are not contractually

contingent upon each other; (2) the repurchase financing entered into between

the parties provides full recourse to the transferee and the repurchase price is

fixed; (3) the financial assets are readily obtainable in the market; and (4)

the financial instrument and the repurchase agreement are not

coterminous. The accounting standards governing the transfer and

servicing of financial assets are effective for the Company beginning January 1,

2010. The Company is currently assessing the effect the new standard

will have on its financial statements.

TWO

HARBORS INVESTMENT CORP.

(a

development stage company)

NOTES TO

UNAUDITED FINANCIAL STATEMENTS

Note

3. Fair Value of Financial Instruments

The

Company is required to disclose the fair value of financial instruments, both

assets and liabilities recognized and not recognized in the consolidated balance

sheet, for which fair value can be estimated.

The

Company’s financial instruments are cash, including cash held in trust

(restricted), and cash equivalents. The carrying value of cash and

cash equivalents approximates fair value because of the short maturities of

these instruments.

Note

4. Income Taxes

For the

three and nine months ended September 30, 2009, the Company recognized

federal tax benefits of $119,483 and $366,268, respectively, resulting from the

available carry-back of net losses of $351,421 and $1,077,258,

respectively. The effective tax rates were (11.5%) and (13.6%),

respectively for the three and nine months ended September 30, 2009 as

compared to the statutory rate of (34%). The difference between the

effective and statutory tax rates was mainly due to the non-deductibility, for

tax purposes, of $0.7 million and $1.6 million of acquisition related costs for

the three and nine months ended September 30, 2009,

respectively.

For the

three and nine months ended September 30, 2008, the Company recognized federal

tax provisions of $182,556 and $1,052,854, respectively. The

effective tax rate of 32% for the nine months ended as compared to the statutory

rate of 34% was driven by the utilization of a tax over accrual for the prior

year.

Note

5. Stockholder’s Equity

As of

September 30, 2009, the Company and its predecessor entity, Capitol, had issued

a certain amount of private common stock in Two Harbors Investment Corp. and

publicly registered common stock of Capitol Acquisition Corp. The

stockholder’s equity as of September 30, 2009 is not reflective of the equity in

the Company post-merger, which is discussed in Note 7 – Subsequent Events of the

Notes to the Financial Statements.

The

following section discloses the components of stockholder’s equity as of

September 30, 2009.

Private

Common Stock of Two Harbors Investment Corp. as of September 30,

2009

As of

September 30, 2009, 1,000 shares of common stock ($0.01 par) were issued and

outstanding. Pine River is the sole owner of this

stock. These shares of Company stock issued to Pine

River on June 11, 2009 upon incorporation were repurchased under the terms of

the completed merger with Capitol on October 28, 2009.

Registered

Preferred Stock of Capitol Acquisition Corp. as of September 30,

2009

Capitol

is authorized to issue 1,000,000 shares of preferred stock with such

designations, voting and other rights and preferences as may be determined from

time to time by the Board of Directors. As of September 30, 2009, no

shares of preferred stock were issued or outstanding, and no preferred stock has

been issued subsequent to such date by either Capitol or the

Company.

TWO

HARBORS INVESTMENT CORP.

(a

development stage company)

NOTES TO

UNAUDITED FINANCIAL STATEMENTS

Registered

Common Stock of Capitol Acquisition Corp. (predecessor of Two Harbors Investment

Corp.)

Capitol

was initially authorized to issue 50,000,000 shares of common stock with a par

value of $.0001 per share. Capitol’s Certificate of Incorporation was

amended prior to the completion of the public offering to increase the number of

authorized shares of common stock from 50,000,000 to 75,000,000.

As of

September 30, 2009, there were 32,811,257 shares of common stock outstanding and

33,249,000 warrants outstanding. All shares of common stock owned by

the Initial Stockholders (a total of 6,562,257 shares) were surrendered and

cancelled as of October 28, 2009, as part of the closing of the merger

transaction with the Company.

Upon

completion of the merger transaction with the Company, Capitol’s outstanding

common stock (other than stock that was cancelled, converted to cash or sold to

Capitol for cash at the closing of the merger), and Capitol’s warrants, were

converted into like securities of Two Harbors Investment Corp., on a one-to-one

basis.

Note

6. Commitments and Contingencies

As of

September 30, 2009, the Company and principally its subsidiary, Capitol, were

parties to various consulting, underwriting and operational

agreements. The majority of these agreements contained terms which

were contingent upon the completion of the merger with the

Company. Subsequent to the completion of the merger, the Company made

payments to the various counterparties and the on-going commitments and

contingencies were otherwise fulfilled. See Note 7 – Subsequent Events of the

Notes to Financial Statements

Note

7. Subsequent Events

On

October 26, 2009, Capitol’s stockholders approved the proposed merger

transaction with the Company, and the transaction closed on October 28,

2009. In connection with the closing, Capitol’s outstanding common

stock and warrants were converted into like securities of the Company, on a

one-to-one basis. The holders of Capitol’s common stock and warrants

became holders of the securities of the Company after the merger in the same

proportion as their holdings in Capitol immediately before the merger, except as

(i) increased by (A) the cancellation of 6,562,257 shares of Capitol

common stock (the “Founders’ Shares”) held by the Initial Stockholders,

(B) conversion of 6,875,130 shares of Capitol common stock sold in

Capitol’s initial public offering (“Public Shares”) by holders thereof who

exercised their conversion rights to have their shares converted from the funds

held in the Trust Account into $9.87 per share and (C) the purchase of

5,994,661 Public Shares pursuant to forward sales agreements that provided for

Capitol to purchase such shares after the closing of the merger at a price of

$9.87 per share and (ii) decreased by the issuance of 22,159 shares of

restricted stock to the Company’s independent directors at the

closing.

In

addition, in connection with the closing of the merger transaction, the Company

entered into a supplement and amendment to the warrant agreement that governs

the warrants, the terms of which, among other things, (i) increased the

exercise price of the warrants from $7.50 per share to $11.00 per share,

(ii) extended the expiration date of the warrants from November 7,

2012 to November 7, 2013 and (iii) limited a holder’s ability to

exercise warrants to ensure that such holder’s Beneficial Ownership or

Constructive Ownership as defined in the Company’s charter does not exceed the

restrictions contained in the charter limiting the ownership of shares of the

Company’s common stock.

The

Company has also entered into a management agreement with PRCM Advisers LLC,

pursuant to which PRCM Advisers LLC is entitled to receive a management fee and

the reimbursement of certain expenses from the Company. PRCM Advisers LLC uses the

proceeds from its management fee in part to pay compensation to Pine River’s

officers and personnel who, notwithstanding that certain of them also are

officers of the Company, receive no cash compensation directly from the

Company. However, the Company reimburses PRCM Advisers LLC for

(i) the Company’s allocable share of the compensation paid by PRCM Advisers

LLC to its personnel serving as the Company’s principal financial officer and

general counsel and personnel employed by PRCM Advisers LLC as in-house legal,

tax, accounting, consulting, auditing, administrative, information technology,

valuation, computer programming and development and back-office resources to the

Company, and (ii) any amounts for personnel of PRCM Advisers LLC’s

affiliates arising under a shared facilities and services

agreement.

TWO

HARBORS INVESTMENT CORP.

(a

development stage company)

NOTES TO

UNAUDITED FINANCIAL STATEMENTS

At the closing, after deducting

transaction costs and expenses and payments to Capitol stockholders, the Company

had approximately $124 million in cash available to fund investments and

operations, and a book value of approximately $9.30 per share. The

cash held by the Company, including the cash held in the Trust Account, totaling

approximately $260 million as of September 30, 2009 was reduced at the

completion of the merger for: (1) payment of approximately

$8 million related to transaction costs incurred and payable upon the close of

the merger for underwriting, accounting, legal, advisory and other transaction

related services, (2) reduction of cash of approximately $127 million

for the conversion or forward sales agreements of Capitol’s public shares into

their pro rata share of the funds in the trust, which equates to the value of

12,869,791 shares of common stock (49.0% of the Public Shares) at a value of

$9.87 per share, the current per share conversion price, and

(3) payment of approximately $0.5 million of operating expenses

incurred by Capitol to support operations up to the closing of the

merger.

As of

December 8, 2009, the Company had acquired a portfolio of its target assets with

an aggregate acquisition cost of approximately $488 million, using the $124

million of cash available to fund investments. The investment

portfolio was comprised of approximately $410 million of agency residential

mortgage-backed securities (“RMBS”), approximately $62 million of non-agency

RMBS and approximately $16 million of interest-only securities. The

Company also had entered into repurchase agreements totaling approximately $264

million with additional repurchase agreements totaling approximately

$119 million expected to be entered into subsequently on settlement of open

trade positions. The initial aggregate portfolio of $488 million

reflects an estimated 95% capital deployment of the target investment portfolio

as of December 8, 2009.

Events

subsequent to September 30, 2009 were evaluated through December 11, 2009, the

date of which these financial statements were issued.

Item

2. Management’s Discussion and

Analysis of Financial Condition and Results of Operations

General

We are a

recently formed company that focuses on investing in, financing and managing

RMBS and mortgage loans and intend to qualify as a real estate investment trust

(“REIT”) as defined under the Internal Revenue Code (“Code”).

The terms

“Two Harbors,” “we,” “our,” and “us” refer to Two Harbors Investment Corp. and

its subsidiaries as a consolidated entity. The term “Capitol” refers

to Capitol Acquisition Corp., which subsequent to the closing of the merger

transaction became a wholly-owned indirect subsidiary of Two

Harbors. Upon completion of the merger, Capitol was considered the

accounting acquirer, similar to a reverse merger. As the surviving entity,

Capitol’s financial information is presented in this Form 10-Q on a historical

carryover basis and the Company has assumed Capitol’s reporting obligations for

the period ended September 30, 2009. As a result, these financial

statements are not indicative of the consolidated financial statements of the

Company subsequent to October 28, 2009. See Note 7 – Subsequent Events of the

Notes to Financial Statements for expanded discussion of the completed

merger.

Our

objective is to provide attractive risk-adjusted returns to our investors over

the long term, primarily through dividends and secondarily through capital

appreciation. We intend to acquire and manage a portfolio of

mortgage-backed securities, focusing on security selection and the relative

value of various sectors within the mortgage market. We seek to

invest in the following asset classes:

|

|

•

|

|

RMBS

for which a U.S. Government agency or a federally chartered corporation

guarantees payments of principal and interest on the securities (“Agency

RMBS”),

|

|

|

•

|

|

RMBS

that are not issued or guaranteed by a U.S. Government agency or federally

chartered corporation (“non-Agency RMBS”),

and

|

|

|

•

|

|

Assets

other than RMBS, comprising approximately 5% to 10% of the

portfolio.

|

We expect

to deploy moderate leverage as part of our investment strategy, through, with

respect to Agency RMBS, short-term borrowings structured as repurchase

agreements and, with respect to non-Agency RMBS, private funding

sources. We may also finance portions of our portfolio through

non-recourse term borrowing facilities and equity financing provided by

government programs, if such financing becomes available.

Our

objective is to capitalize on the current dislocation impacting the residential

mortgage market by acquiring, financing and managing a diversified portfolio of

our target assets. Since 2007, adverse changes in financial market

conditions have resulted in a deleveraging of the global financial system and

the sale of large quantities of mortgage-related and other financial

assets. As a result of these conditions, many traditional mortgage

investors have suffered severe losses in their residential mortgage portfolios

and several traditional providers of capital have left the market, resulting in

a significant contraction in market liquidity for mortgage-related

assets. These circumstances have created the opportunity to acquire

RMBS assets at lower values and higher yield compared to prior

periods.

We are a

Maryland corporation that commenced operations upon completion of the merger

with Capitol, which is described in more detail below. We intend to elect and

qualify to be taxed as a REIT for U.S. federal income tax purposes, commencing

with our initial taxable period ending December 31, 2009. To

qualify as a REIT we will be required to meet certain investment and operating

test and annual distribution requirements. We generally will not be subject to

U.S. federal income taxes on our taxable income to the extent that we annually

distribute all of our net taxable income to stockholders and maintain our

intended qualification as a REIT. However,

certain activities that we may perform may cause us to earn income which does

not qualify for the REIT purposes. We have preserved Capitol as a taxable REIT

subsidiary (or “TRS”), as defined in the Code, to engage in such activities, and

we may in the future form additional TRS’s. We also intend to operate

our business in a manner that will permit us to maintain our exemption from

registration under the Investment Company Act of 1940, as amended (the “1940

Act”).

Capitol

Acquisition Corp. (as of September 30, 2009 and pre-merger)

Capitol

was a blank check company formed under the laws of the State of Delaware on

June 26, 2007 to effect a merger, capital stock exchange, asset

acquisition, stock purchase, reorganization or similar business combination with

one or more businesses or assets. On November 14, 2007, Capitol

completed its initial public offering of 25,000,000 units at a price of $10.00

per unit. Capitol received net proceeds of approximately $239.8

million from its initial public offering. Each unit consisted of one

share of Capitol’s common stock and one Redeemable Common Stock Purchase

Warrant. Each warrant entitled the holder to purchase from Capitol

one share of common stock at an exercise price of $7.50 commencing the later of

the completion of a Business Combination or November 8, 2008 and expiring

November 8, 2012.

Capitol

received proceeds of $12,021,625, net of underwriting discounts of $468,375, on

December 12, 2007, as a result of the underwriters exercising their

over-allotment option of 1,249,000 units.

Pursuant

to subscription agreements dated October 12, 2007, certain of the Initial

Stockholders, purchased from Capitol, in the aggregate, 7,000,000 warrants for

$7,000,000. The purchase and issuance of these warrants occurred

simultaneously with consummation of the IPO on a private placement

basis. All of the proceeds received from the foregoing sale of

securities were placed in the Trust Account.

Capitol

Acquisition Corp. (post-merger)

On

October 26, 2009, the majority of Capitol’s stockholders approved the

proposed merger transaction with Two Harbors, and the transaction closed on

October 28, 2009. In connection with the closing, Capitol’s

outstanding common stock and warrants were converted into like securities of the

Company, on a one-to-one basis. The holders of Capitol’s common stock

and warrants became holders of the securities of the Company after the merger in

the same proportion as their holdings in Capitol immediately before the merger,

except as (i) increased by (A) the cancellation of 6,562,257 shares of

Capitol common stock (the “Founders’ Shares”) held by the Initial Stockholders,

(B) conversion of 6,875,130 shares of Capitol common stock sold in

Capitol’s initial public offering (“Public Shares”) by holders thereof who

exercised their conversion rights to have their shares converted from the funds

held in the Trust Account into $9.87 per share and (C) the purchase of

5,994,661 Public Shares pursuant to forward sales agreements that provided for

Capitol to purchase such shares after the closing of the merger at a price of

$9.87 per share and (ii) decreased by the issuance of 22,159 shares of

restricted stock to the Company’s independent directors at the

closing. In addition, in connection with the closing, the Company

entered into a supplement and amendment to the warrant agreement that governs

the warrants, the terms of which, among other things, (i) increased the

exercise price of the warrants from $7.50 per share to $11.00 per share,

(ii) extended the expiration date of the warrants from November 7,

2012 to November 7, 2013 and (iii) limited a holder’s ability to

exercise warrants to ensure that such holder’s Beneficial Ownership or

Constructive Ownership as defined in the Company’s charter does not exceed the

restrictions contained in the charter limiting the ownership of shares of the

Company’s common stock.

In

accordance with the merger agreement, Capitol merged with and into Two Harbors

Merger Corp., a wholly-owned subsidiary of Two Harbors, with Capitol being the

surviving entity and becoming a wholly-owned subsidiary of Two

Harbors.

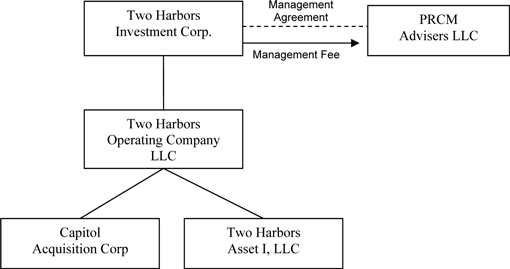

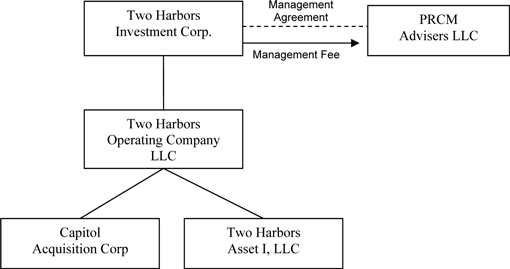

The

following chart shows our structure subsequent to the completion of the

merger. We conduct substantially all of our operations through our

wholly-owned subsidiary, Two Harbors Operating Company LLC (the “Subsidiary

LLC”). The Subsidiary LLC in turn conducts its business through two

separate subsidiaries, which hold different combinations of our target asset

classes. Capitol is one such subsidiary, which we have elected to treat as a

TRS.

Recent

Developments

Following

the completion of the merger transaction on October 28, 2009, we have been

actively working to deploy our initial capital of $124 million. As of

December 8, 2009, we have invested the net proceeds from the merger transaction,

as well as funds that we borrowed under repurchase agreements, to purchase

approximately $488 million of RMBS. The following table depicts the

investment portfolio composition:

|

Agency

Bonds

|

|

Amount

($M)

|

|

Weighted

Average

Coupon

(%)

|

|

Weighted

Average

Price

($)

|

|

Estimated Yield

Range1 (%)

|

|

Fixed

Rate Bonds

|

|

$99

|

|

5.23%

|

|

$104.6

|

|

4.00-4.30%

|

|

Hybrid

ARMs

|

|

$311

|

|

4.38%

|

|

$104.9

|

|

2.25-2.50%

|

|

Total

Agency

|

|

$410

|

|

-

|

|

-

|

|

2.60-3.00%

|

|

|

|

|

|

|

|

|

|

|

|

Non-Agency

Bonds

|

|

Amount

($M)

|

|

Weighted

Average

Coupon

(%)

|

|

Weighted Average

Price

($)

|

|

Estimated Yield

Range1 (%)

|

|

Senior

Bonds

|

|

$37

|

|

2.86%

|

|

$55.3

|

|

8-12%

|

|

Mezzanine

Bonds

|

|

$25

|

|

2.55%

|

|

$38.9

|

|

12-20%

|

|

Total

Non-Agency

|

|

$62

|

|

-

|

|

-

|

|

10-15%

|

|

|

|

|

|

|

|

|

|

|

|

Interest

Only Bonds

|

|

Amount

($M)

|

|

Weighted

Average

Coupon

(%)

|

|

Weighted Average

Price

($)

|

|

Estimated Yield

Range1 (%)

|

|

IO

Bonds

|

|

$16

|

|

-

|

|

-

|

|

10-15%

|

|

(1)

|

Actual

realized yields will depend on realized prepayment speeds for Agency

bonds. In addition to prepayment speeds, actual yields will

depend on the timing and extent of loan defaults and recoveries for

Non-Agency bonds. Estimated yields do not include any costs of

operating or managing Two Harbors and are not an indication of estimated

earnings.

|

We have

entered into master repurchase agreements with five

counterparties. As of December 8, 2009, we had borrowed $264 million

under those master repurchase agreements to finance our purchase of agency

RMBS. In addition, we expect to borrow an additional $119 million for

the funding of the securities noted above to settle open trade

positions. The estimated weighted average rate for our total

borrowing is 0.34% and our current debt to equity ratio will be approximately

3.09:1.

Overall,

we have deployed approximately 95% of the portfolio’s target aggregate

investments as indicated by the following table:

|

Aggregate

Capital for Investment ($M)

|

|

$124

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Asset

|

|

Target

Allocation

(%)

|

|

Capital for

Investment1 ($M)

|

|

Assumed

Haircut

(%)

|

|

Total Target

Assets1 ($M)

|

|

Total

Assets Purchased ($M)

|

|

Invested

(%)

|

|

Agency

|

|

30

- 35%

|

|

$40

|

|

10%

|

|

$400

|

|

$410

|

|

100%

|

|

Non-Agency

Senior

|

|

25

- 30%

|

|

$34

|

|

50%

|

|

$68

|

|

$37

|

|

54%

|

|

Non-Agency

Mezzanine

|

|

15

- 25%

|

|

$25

|

|

100%

|

|

$25

|

|

$25

|

|

100%

|

|

IO

Bonds

|

|

10

- 20%

|

|

$19

|

|

100%

|

|

$19

|

|

$16

|

|

84%

|

|

Cash2

|

|

0 -

10%

|

|

$6

|

|

100%

|

|

|

|

-

|

|

-

|

|

|

|

100%

|

|

$124

|

|

|

|

$512

|

|

$488

|

|

95%

|

|

(1)

|

Portfolio

assumes mid-point of the range for each asset class.

|